Hi! Today I’ll start a new saga about management in trading it will be divided in three parts.

1) Trade Management (how to manage an open position)

2) Risk Management (how to choose which risks to take and which not, the importance of Risk:reward)

3) Money Management (how much to risk? how to do it?)

Today we will discuss about how can we manage a trade with pros and cons of several methods so you can choose the one you prefer and that suits better your personality.

Trade management is one of the most important area of trading and it can became the difference between a winning and a losing trader. Maybe you’ve listened often the quotes that says “Let the profits run” but how much? Are you going to make them run until you lose all the gain? And what if you close them and the prices continues to go your way? Did you missed an opportunity? Let’s discuss some psychological and scientific approach to this problem.

Hold of Fold?

I’ve a rule for myself. Usually I don’t do nothing at least until I doubled my initial risk. That’s why I never enter on a trade if the price is contrasted by a strong support or resistance before this level. My exit strategy is usually set and forget. I set a target and wait for the price to reach it but there are some exceptions and different methods to manage a trade. If your price reached a 1:3 1:4 risk reward I usually close it but you can also:

1) Wait for a signal in the opposite direction

2) Move the SL under the 8 EMA in a trending market

3) Move the SL under the previous lows

These are the methods used my the most to manage an open trade.

All you read above is not suggested by me. I think that a beginner in forex trading can do better with a set-and-forget strategy with some little rules added than when is too involved. The important thing is that you don’t let your emotions overcome your plan. Never. As always in fact psychology is heavily decisive.

Break-even trades, smart or scared?

When you set your SL at break-even you usually stand more quiet and this can be good for the emotional traders to help them manage a position. A lot of people are used to move a trade to break-even when it reaches a 1R profit and trail it for an R every time. Example: My SL is 100 pips. I gain 100 pips and move my SL to 0, i make 200 pips and move my SL to 100, until it reach my target. I don’t like this kind of trailing because it has no reasons for a stop moving technically. If you find too much break-even trades maybe you are doing something wrong.

To me going break-even is on the long-term a losing approach (not losing but less profit), this is because if you use a risk reward of 1:3 or higher is better lose a position sometimes than close it break-even and lose a winner.

Averaging in and out

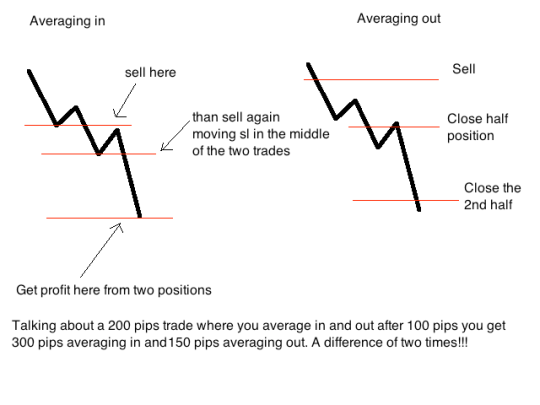

Other kind of trade management are the ones of averaging in and out.

Averaging in means that you add to a position paying it with the profit you made until that time. You can do it for example on every confirmation signal you get on the road to your target. It can be a very interesting strategy to make some very big winners! But often you’ll get a lot of break-even too. I find it stressful for me but for sure it can carry a positive expectation.

Averaging out is the contrary or close partially a position and than let the remaining run until you think is necessary. I find it instead useless. You leave the big profits and when you lose a position is a full loser. On the long-term this is not useful.

In the end the best way to get the most from a trade for me is to make a good analysis and trace the most important support and resistance and try to aim them without any SL moving. Often you’ll close the positions a little before they’ll retrace for hundreds of pips. And you’ll give the market the possibility to show how your edge works profitably when you are not present 🙂

Comments on: "The Management Series – Trade Management" (1)

[…] The Management Series – Trade Management (teachingtrading.wordpress.com) Share this:TwitterFacebookEmailStumbleUponLike this:LikeBe the first to like this post. […]